Health insurance

The Company Transparency Act: A Reporting Information for Medical Teams and MSOs

[ad_1]

Congress handed the Company Transparency Act (the “CTA”) in 2021 with the purpose of enhancing transparency in entity constructions and possession in addition to combating terrorism, cash laundering, and different types of company misconduct. This sweeping new rule is designed to forged a large internet over entities that, besides within the case of taxes, don’t often report back to federal companies (i.e., non-publicly traded entities), whatever the diploma to which they’re already regulated on the state degree. This publish particularly speaks to medical teams and administration providers organizations (“MSOs”) that now have to navigate the brand new CTA necessities and account for his or her advanced contractual relationships (e.g., administration providers agreements, fairness restriction or succession agreements). For extra data on a selected subject, hyperlinks to useful assets have been supplied within the footnotes.

Broadly talking, the CTA requires that any entity that qualifies as a “reporting firm” file a Helpful Possession Info Report (“BOIR”) to the Division of the Treasury’s Monetary Crimes Enforcement Community (“FinCEN”) disclosing figuring out data for such entity’s key homeowners and leaders (“helpful homeowners”). Firms shaped on or after January 1, 2024, should additionally embrace data on the person who supervised the preparation of the certificates of formation of the reporting firm in addition to the person who filed such doc with the Secretary of State within the state of formation (known as the “firm applicant”). Whereas this reporting requirement can be new for a lot of privately owned entities, the excellent news is that the BOIR is pretty easy, and FinCEN has confirmed that any data submitted in a BOIR can be confidential. Authorities officers could solely entry such data for nationwide safety, intelligence, and regulation enforcement functions. Moreover, monetary establishments could solely entry the data with the consent of the reporting firm.[1]

Even so, the CTA has sparked substantial public commentary across the nuances of reporting and the scope of potential exemptions. For entities that traditionally haven’t needed to make these kind of disclosures, the CTA raises a lot of questions, together with whether or not an entity can qualify for an exemption, and if not, what data should be reported to the federal authorities. There’s time to assume by means of these questions. Reporting firms that aren’t exempt and have been registered to do enterprise with their relevant Secretary of State previous to January 1, 2024, have till January 1, 2025 to file their BOIR. The timeline for newer reporting firms is just a little shorter: these registered between January 1, 2024 and January 1, 2025, may have ninety (90) days following registration to file, and people registered after January 1, 2025, may have thirty (30) days following registration to file.

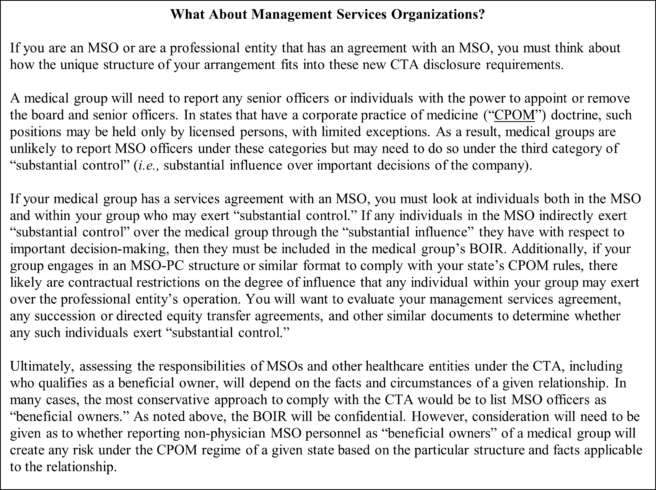

The CTA’s utility to widespread company constructions within the healthcare trade (e.g., “pleasant doctor” and MSO relationships) raises questions for reporting firms topic to the brand new necessities. Specifically, medical teams might want to think about whether or not particular person leaders of an MSO must be reported as “helpful homeowners” of an affiliated medical group. Like different healthcare compliance points, every reporting firm ought to think about the details and circumstances of its current relationships and, for medical teams, whether or not an MSO relationship will influence its BOIR submission (e.g., the diploma of management afforded to the MSO beneath its administration providers settlement, any relevant CPOM doctrine(s), and the concerned reporting entity’s evaluation of its authorized duties and diploma of danger tolerance).

Right here, we element three steps to contemplate with respect to CTA reporting for medical teams and MSOs:

Step 1: Are You a “Reporting Firm” and, If So, Does an Exception Apply?[2]

An entity is a reporting firm if it was shaped or registered to do enterprise by submitting with any Secretary of State or comparable workplace inside the US (e.g., a company or LLC). Because of this any skilled company or skilled restricted legal responsibility firm is a reporting firm, however a sole proprietorship or normal partnership that isn’t registered with a Secretary of State or comparable state workplace just isn’t.

Even when your entity is a reporting firm, it could meet one of many exceptions beneath the CTA that eliminates the reporting requirement. The exceptions are primarily designed to exempt bigger firms with lively operations, public firms, and different entities that already report back to the federal authorities (i.e., these registered with the Securities Change Fee (“SEC”), together with funding firms, funding advisers, enterprise capital fund advisers, and pooled funding automobiles). Tax exempt entities, comparable to charitable organizations organized beneath IRS Code 501(c)(3), in addition to any entities wholly owned by a number of exempt entities are excluded as nicely. Inactive entities additionally don’t have to report.[3] Lastly, the Giant Working Firm (“LOC”) exception waives an entity’s reporting obligation if it satisfies the entire following necessities: 1) employs twenty-one (21) or extra full-time workers within the U.S. (unbiased contractors, leased workers, [4] or, for an S company, any shareholder proudly owning two % (2%) or extra possession[5] don’t depend as workers), 2) generates greater than 5 million {dollars} ($5,000,000) in annual gross receipts (as reported within the federal revenue tax returns of the 12 months prior), and three) has an working presence at a bodily workplace within the U.S.[6]

If your organization meets any of the above exceptions, it isn’t required to file a BOIR. In any other case, it would be best to begin excited about which people should be recognized within the BOIR.

Step 2: If You Should File a BOIR, Establish Your “Helpful Proprietor(s).”

A. Who’s a “Helpful Proprietor?”[7]

A helpful proprietor is a person who, straight or not directly, both 1) workout routines substantial management over a reporting firm, or 2) owns or controls a minimum of twenty-five % (25%) of the “possession pursuits” of a reporting firm.

B. What’s an “Possession Curiosity?[8]

An possession curiosity consists of, however just isn’t restricted to, any of the next: 1) fairness, inventory, or voting rights, 2) a capital or revenue curiosity, 3) convertible devices, or 4) choices or different non-binding privileges to purchase or promote any such pursuits.

C. What’s “Substantial Management?”[9]

A person has “substantial management” in the event that they meet any of the next three standards: 1)serves as a senior officer of the corporate, 2) holds authority over the appointment or removing of senior officers or a majority of the board, or 3) has substantial affect over essential selections of the corporate. In defining “senior officers,” FinCEN expressly consists of the President, CEO, CFO, GC, COO, or some other officer who performs an identical operate, and expressly excludes any ministerial positions comparable to a Company Secretary or Treasurer. For healthcare entities, sure officer positions, comparable to CMOs, don’t appear to suit neatly into both a “senior officer” or “ministerial” position. The most secure strategy is prone to embrace such people within the report, however the determination warrants case-by-case consideration.

When deciding whether or not a person meets the third class of “substantial affect over essential selections,” the CTA seems to be to people who’ve substantial affect over any of the next selections: 1) the character, scope, and attributes of the corporate together with the sale, lease, mortgage, or different switch of principal property, 2) any reorganization, dissolution, or merger, 3) the choice or termination of enterprise strains or ventures, 4) any compensation schemes or incentive applications for senior officers; and 5) the entry into or termination of great contracts.

The CTA features a catch-all provision to make clear that substantial management can take further varieties not particularly listed. Moreover, substantial management additionally consists of management exerted by any father or mother or middleman entities. Thus, if any people from different entities exert management over your organization pursuant to the above classes, you will want to incorporate them in your BOIR.

Step 3: Think about the Who, What, When, The place and How of CTA Reporting

Reporting firms should embrace data on each the reporting firm and any helpful homeowners. Moreover, any firms shaped after January 1, 2024, should embrace data on firm candidates. FinCEN has further assets obtainable on-line for newly shaped reporting firms. Reporting firm data consists of: 1) its full authorized identify, 2) any commerce identify (i.e., “d/b/a”), 3) a enterprise avenue tackle (this can’t be a PO field or any third occasion’s tackle), 4) the state of formation the place the corporate first registered, and 5) its taxpayer identification quantity.

Helpful proprietor data consists of every particular person’s: 1) full authorized identify, 2) date of start, 3) residential avenue tackle (this can’t be an organization tackle), 4) ID quantity and issuing jurisdiction of a non-expired US passport, driver’s license, or different government-issued ID, and 5) a picture/photocopy of such ID. If the person doesn’t want for his or her ID to be saved within the BOIR (Gadgets 4 and 5), they will apply for a novel figuring out quantity by means of FinCEN (a “FinCEN Identifier”). To take action, a person should submit all helpful proprietor data outlined above (together with an ID quantity and photocopy) by means of the FinCEN web site right here, FinCEN ID | Monetary Crimes Enforcement Community (FinCEN). The FinCEN Identifier can then be submitted on the BOIR in lieu of Gadgets 4 and 5 above.[10]

Firms could make the report electronically at BOI E-FILING (fincen.gov) by both submitting a pdf kind or getting into the data straight. Recall that reporting firms shaped previous to January 1, 2024, don’t want to incorporate firm applicant data. Merely verify the field in Merchandise 16 to skip Half II on firm candidates. The deadlines for reporting firms based mostly on their date of state registration are outlined above.

FOOTNOTES

[1] See Part A of Helpful Possession Info Reporting FAQ, Helpful Possession Info Reporting | FinCEN.gov.

[2] See Pages 2-14 of Small Entity Compliance Information, FinCEN (hereinafter, the “FinCEN Information”) https://www.fincen.gov/websites/default/information/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf.

[3] Id. at p. 14.

[4] 26 C.F.R. § 54.4980H-1; 26 C.F.R. § 31.3401(c)-1.

[5] 26 C.F.R. § 54.4980H-1.

[6] Though consolidated teams could combination gross receipts for the LOC exception, the variety of workers in a gaggle might not be consolidated, that means every firm will need to have 21 or extra US workers to qualify for the exception.

[7] FinCEN Information, p. 16.

[8] Id. at p. 18.

[9] Id. at p. 18.

[10] See Part M of Helpful Possession Info Reporting FAQ, Helpful Possession Info Reporting | FinCEN.gov.

[ad_2]

#Company #Transparency #Act #Reporting #Information #Medical #Teams #MSOs

Supply hyperlink